As a homeowner, you have a lot of responsibilities – from maintaining your property to securing homeowner’s insurance and much more. One responsibility is making your mortgage payments on time month after month. And while this can be a financial burden, there are unfortunate consequences if you miss a payment.

When you – the mortgage borrower – fail to make your monthly house payment, your property will eventually enter foreclosure. This is a process that allows lenders (banks or other financial institutions) to recover the balance of your defaulted loan by repossessing or selling your property.

The Legislature has provided two methods of foreclosure for deeds of trust: judicial foreclosure (under RCW 61.12) and nonjudicial foreclosure (under RCW 61.24). There are substantial differences in the respective rights of lenders and borrowers under each, which arise from the particular history of each statute.

The details of each vary by state, which is why we are covering the difference between judicial and nonjudicial foreclosure in Washington State.

JUDICIAL FORECLOSURE:

In a judicial foreclosure, once the bank files a foreclosure lawsuit against you, you (the homeowner) receive a court summons and a copy of the foreclosure complaint. Then, you can either let the foreclosure happen or contest the foreclosure lawsuit in court. If you decide to contest it, the court will hold a hearing and a judge will decide whether to approve the sale. If the sale is approved, a date is set, and, upon sale, you relinquish your home. If you don’t contest the foreclosure, the court issues a “default judgment” and automatically approves the sale.

NONJUDICIAL FORECLOSURE :

Nonjudicial foreclosure under the Act, RCW 61.24, is a quick and inexpensive alternative to judicial foreclosure. In nonjudicial states, the lender can foreclose on a property through a third party, otherwise known as a “trustee”. Then state law determines the timeline of the foreclosure process, including how much notice you will receive and how the home will be sold.

The good news is that even after you’re served with a notice of default, you have up to 120 days to make up your missed payments. If you can’t make up the missed payments or work out a payment schedule with your lender, then you’ll receive a notice of intent to sell the property.

Is Washington State a Nonjudicial Foreclosure State?

Yes – Washington is a non-judicial foreclosure state in that a lender can foreclose on a property through a third party instead of through the courts. The Washington State Legislature adopted the Act in 1965 because it was concerned that the cumbersome judicial foreclosure procedures were inhibiting residential financing in the state.

How Long Do Judicial and Nonjudicial Foreclosures Take?

One other difference between judicial and nonjudicial foreclosures is their timelines. A judicial foreclosure process can take anywhere from three and a half months to several months or even several years. This is especially the case if you respond to the foreclosure summons and are able to delay the court’s judgment.

Nonjudicial foreclosures, on the other hand, happen much faster – often within a matter of months. This is because the trustee doesn’t need the court’s involvement in order to auction off the property. In some states, this can take as little as 30 days!

Avoid Foreclosure in Washington State

If you’re worried that you may face foreclosure due to missing one or several mortgage payments, seek legal assistance as soon as possible.

You may have options in terms of avoiding foreclosure. Contact foreclosure defense attorney Jeff Jared to find out your options and protect your home in Washington State.

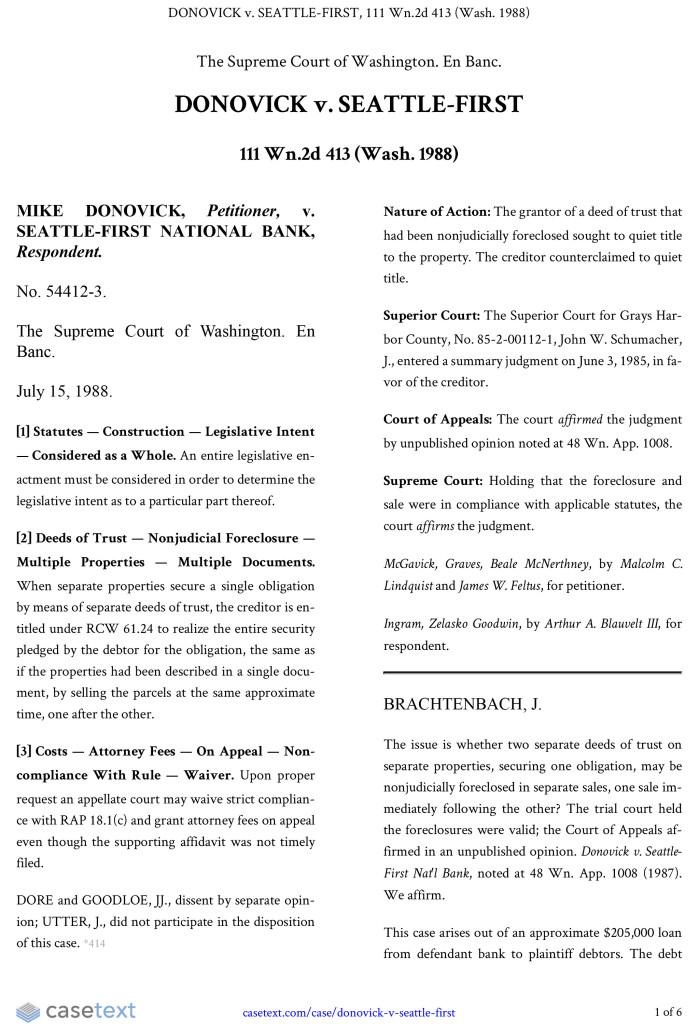

EXAMPLE OF JUDICIAL AND NONJUDICIAL FORECLOSURE CASE LAW

The Supreme Court of Washington. En Banc. DONOVICK v. SEATTLE-FIRST 111 Wn.2d 413 (Wash. 1988)

Download the full case text (.pdf) here: